TIAA

TIAA called upon MCD Partners to simplify and optimize one of their many tools for individuals preparing for retirement. Our team was responsible for designing and developing the Retirement Profile interface, which helps users define what life will be like after retirement as well as an interactive tool for customizing an income plan.

MY ROLE

UX/UI Designer – Analyzed the research and initial brief we received from the client. Evaluated current product experience and produced wire-flows and wireframes for our optimization strategy. Collaborated with UX Designers, Creative Director and Front-End Developers to generate low-fidelity prototypes, visual design and responsive HTML code. Assisted in conducting usability testing in our in-house facility.

THE ASK

ENHANCING THE EXPERIENCE

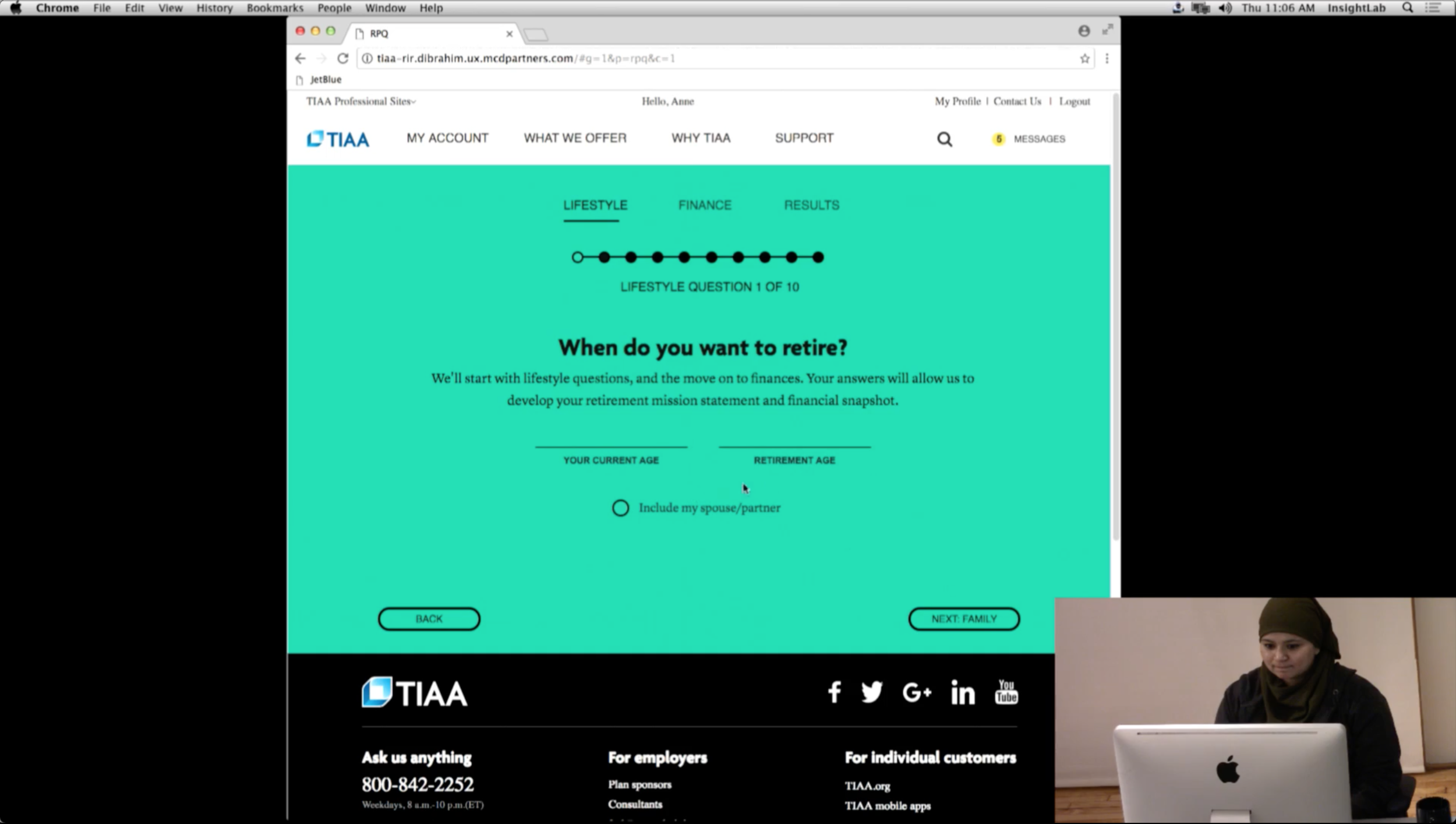

TIAA (Teachers Insurance and Annuity Association) offers a variety of products and services for people looking to invest and plan for their retirement. One of these is a tool called the Retirement Profile - an educational tool designed to help users (within 5 years of retirement) envision their retirement lifestyle, directionally assess their income readiness and educate themselves on key topics to help prepare for retirement. The tool is intended to be a starting point to help users think through the emotional and financial aspects of retirement. While this tool is mainly educational, users have the ability to contact a TIAA or third party advisor and begin to put an actual plan in place.

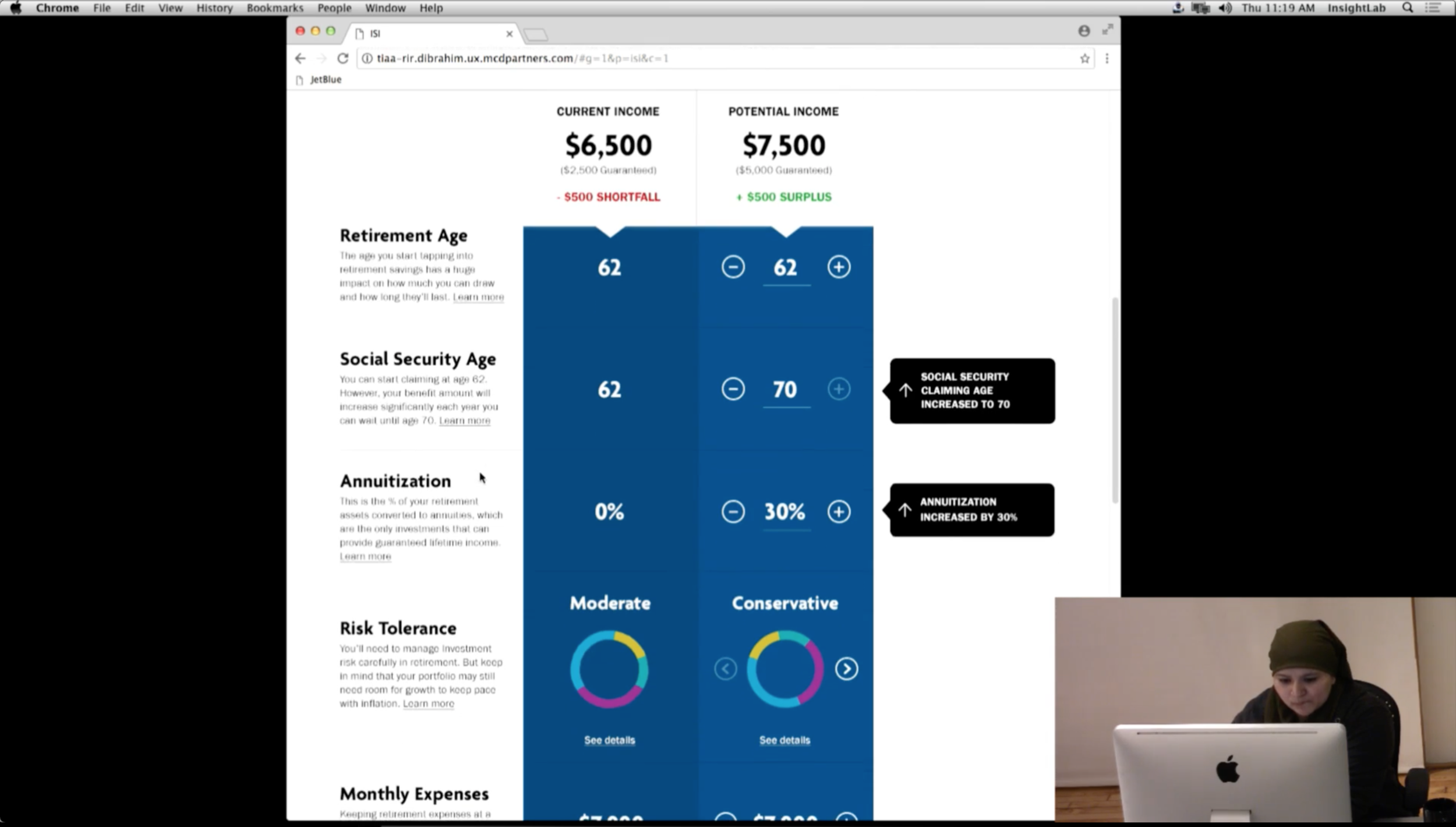

Our task was to enhance the Retirement Profile experience by simplifying the amount of information available to users, while also building an extension of the tool for users to customize their personal income plan. Where this tool was once just a projection of life in retirement, users will now have the ability to dig deeper and customize that projection.

THE CURRENT EXPERIENCE

UNDERSTANDING THE FLOW

As previously stated, our job was to not completely disrupt the current UX but rather to optimize and enhance. Therefore, understanding the existing user flow was imperative. Below you will see a graphic representing key components in the critical path of the product:

Although the scope of this project involved many screens, the above are the main pillars of the product. The PFR landing page serves as the entry point and directs users to fill out the Retirement Profile Questionnaire (RPQ), prompting users with lifestyle and financial questions that will shape their Retirement Profile. In additional to giving the user a lifestyle and financial snapshot of their life in retirement, the Retirement Profile also allows users to plot significant events on a personilzed timeline, link to valuable article content, customize their income plan by linking to the Income Strategies Interface (ISI) and contact an advisor to start implementing the plan.

Below is a detailed representation of the critical path for users and overall scope of the project:

THE RESEARCH

WHAT WE LEARNED

Below you will find research that TIAA provided in their initial brief:

BACKGROUND

Past research has demonstrated that TIAA participants are inclined to click through the Preparing for Retirement (PFR) experience and call a TIAA representative.

Participants have also felt generally positive about the idea of gaining some initial retirement income planning education before talking to TIAA. They felt more confident about their ability to retire successfully after seeing the concept content and more likely to call TIAA.

OBJECTIVE

This research focuses on further understanding how Transitioners and Established participants perceive TIAA’s Preparing for Retirement experience, including:

• The usability and experience of the PFR section of the website

• Their interest and likelihood of completing the Retirement Questionnaire and reactions to the Retirement summary

• Reactions to TIAA’s 4Preparing for Retirement targeted emails

While there are users at many different stages of their retirement, TIAA has established two groups of users - Established and Transitioning. Below are the findings on each group in relation to the existing web experience:

In general, Established participants feel more confident about retirement.

Established participants more commonly feel confident that they’ll be able to retire in a comfortable lifestyle and they also think they’ve been more effective in planning for retirement than Transitioners. This suggests that there may be less of a need for retirement planning help and guidance for the Established group.

Transitioners show more interest in participating in the 'Preparing for Retirement' experience.

As many Established participants have already completed the Questionnaire and/or feel the material is no longer relevant as they are past that life stage, it is not surprising that Transitioners show a greater level of interest in engaging with TIAA to help plan for retirement and also greater interest in completing the Retirement Profile and Questionnaire. Transitioners are also slightly more likely to see themselves using the Retirement Summary.

The ‘Take these steps to prepare for a conversation about an income plan’ section of the profile page is especially helpful.

Transitioners and Established segments alike are most likely to be first drawn to this section of the webpage. They also find this section to be the most helpful among all areas of the webpage. As for the other sections, while very few thought they were not helpful, the few that did thought they already knew the information or thought it was not representative of their unique situation

KEY TAKEAWAYS

Continue to focus on ways to show that TIAA’s retirement advice is tailored to its clients’ unique situations.

Most of these enhancements are geared toward Transitioners who are clearly are more invested in their retirement profile.

THE FRAMEWORK

WIREFRAMES & PROTOTYPES

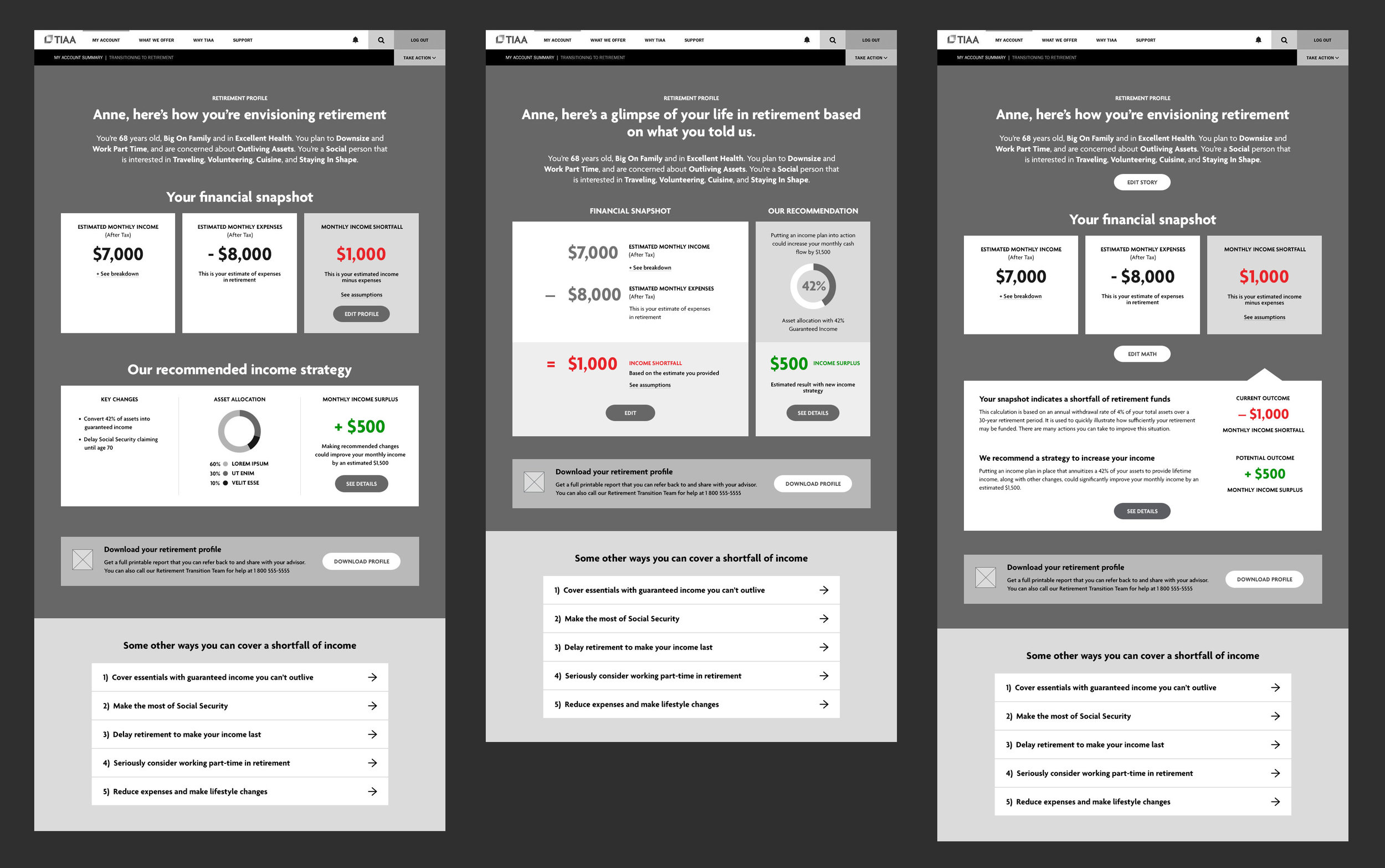

Soon after we deciphered the research and evaluated how far we wanted to push the design, taking into consideration development time and budget, we jumped into wireframing the Retirement Profile page and Income Strategy Interface.

3 iterations of the Retirement Profile page

3 different iterations of the Income Strategy Interface

THE PRODUCT

NEW & IMPROVED

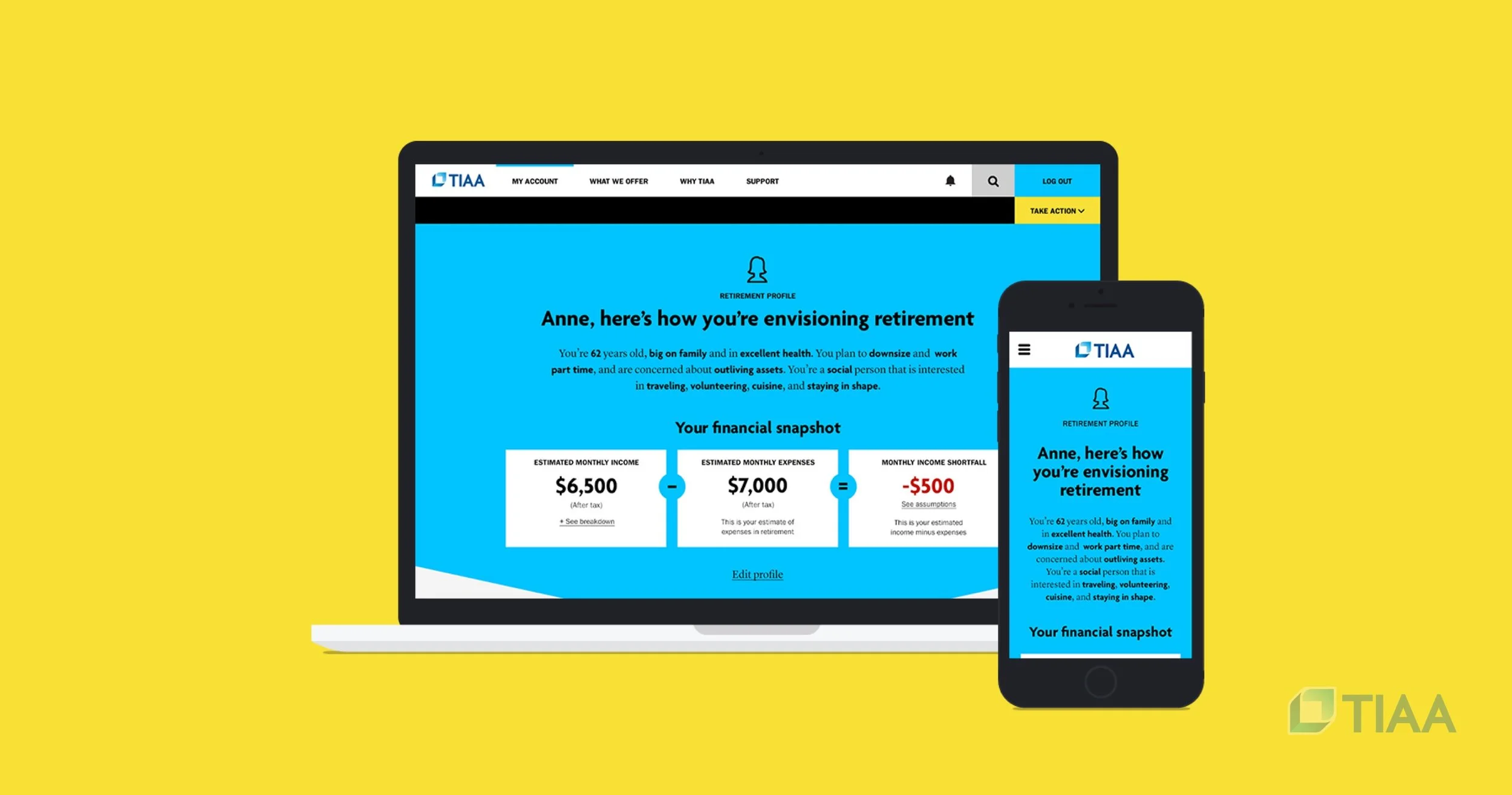

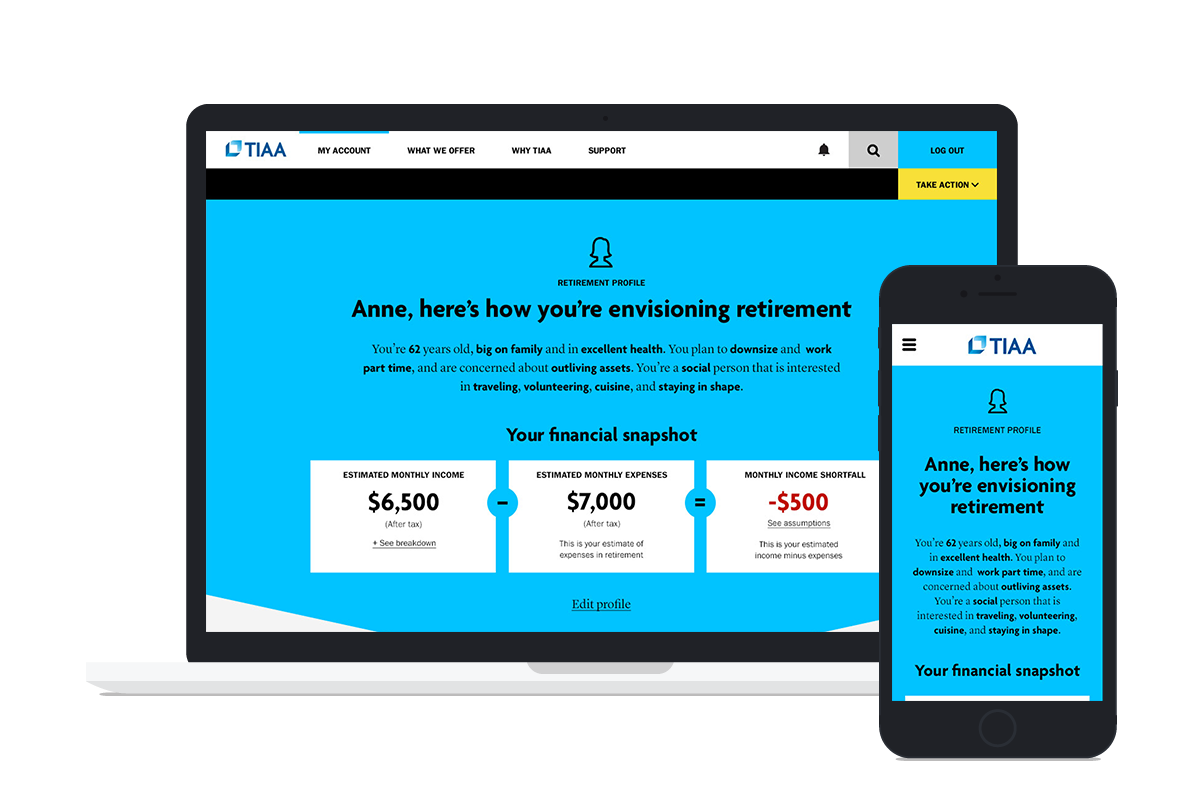

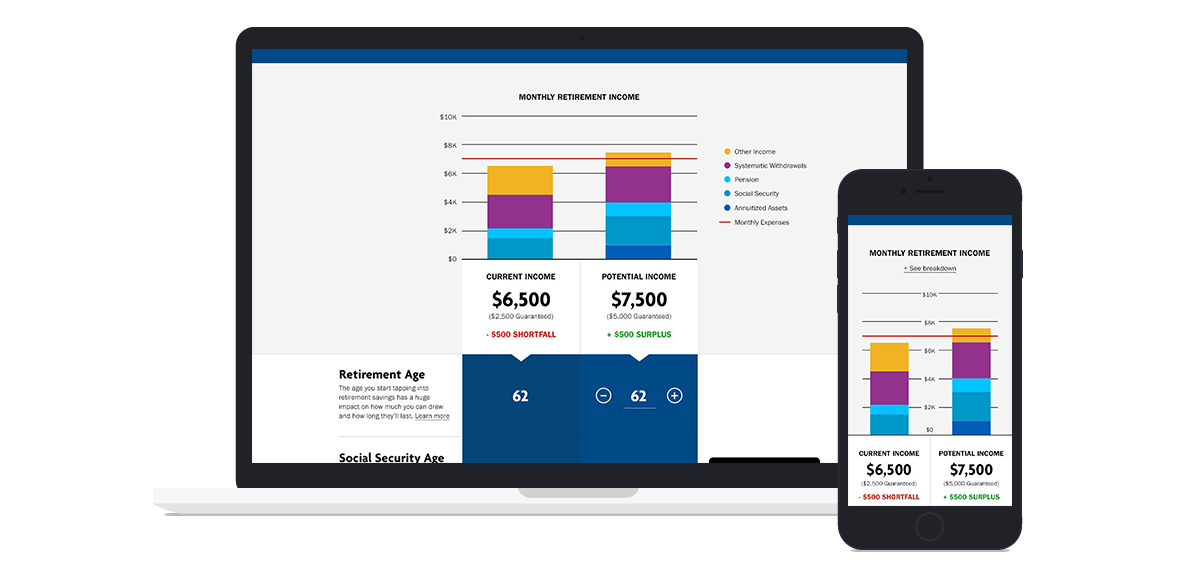

Since we had the existing experience and TIAA's design guidelines as a starting point, we were able to efficiently produce a fully designed prototype for testing. Here are some key screens below:

One big challenge with this project was the ISI page (below). Consolidating the many factors of an income plan into a digestible and easily customizable experience was not an easy task, especially in mobile viewport.

Links to prototype available upon request

USABILITY TESTING

WHAT WE LEARNED

Using our interactive prototype we conducted a series of user tests with TIAA and C Space, a customer growth agency. Below are some high level insights and themes from our two-day session:

HIGH LEVEL THEMES

Emotional state: Equal feelings of excitement and trepidation about boredom and outliving assets.

Financial readiness: Kind of. Hope so. Maybe.

Tool expectations: Modeling. Show me what I have. Help me adjust my budget and spending. Give recommendations.

Onboarding questions: Opportunity to divulge how each question plays into the recommendations that will be given at the end.

Users’ preferred method of getting help is “chat” or “call” TIAA advisor.

Call to action buttons were often missed because of incorrect hierarchy or text/wording confusion. “Compare & Customize” was particularly confusing and problematic for participants.

The profile summary is a nice personal touch, but takes up a disproportionate amount of real estate.

INTERESTING INSIGHTS

One member stated that he felt financially over-prepared and wanted to make sure that he was spending enough of his money. "You can't take it with you, I don't want to leave it behind. How do I make sure I'm using enough of it?"

Most valuable stated as: graphical representation and recommendations.

Least valuable: personality type, separate tabs.

Overall, one of the biggest insight themes was users were not as interested in the lifestyle summary on the profile page. Users wanted and appreciated TIAA's recommendations, and while most enjoyed the ability to customize their income plan, there was trepidation against altering that financial recommendation.

IN CONCLUSION

GOING FORWARD

Overall, our team was successful in simplifying the Retirement Profile page and adding features for users to customize their income plan and their personal retirement timeline. However, while these additional features showed up as a "nice to have" in user testing, it is unclear how much value they actually add for customers who primarily rely on professional recommendation. Going forward we will watch activity closely and evaluate how we can improve this product as we continue to work with TIAA.